Here is how debt relief programs may work

In three easy steps, you can get matched with third-party providers who offer free debt relief consultations.

Gathering information

Using the information you provide, you’ll be matched with professionals who can outline possible programs and help you understand your options.

Providing options

You’ll be presented with potential debt relief options from independent professionals, including examples of how such programs may reduce your overall burden.

Negotiating with creditors

Third-party specialists can explain whether you may qualify for programs where negotiations with creditors are used to seek more manageable repayment options.

Explore solutions for credit card debt relief

Managing debt can feel overwhelming, but you don’t have to face it alone. We connect you with independent consultants who can explain available programs and discuss options that may help make your payments more manageable.

Get relief

Support from trusted providers

Negotiating with creditors and exploring debt relief programs often requires expertise. Independent companies in our network have extensive experience helping individuals and businesses review their options and consider restructuring possibilities.

Get relief

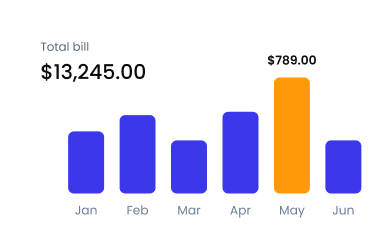

Over $100 million in debt successfully resolved by our trusted partners

Third-party debt relief companies we connect users with report having supported thousands of people through various programs, including cases involving substantial amounts of debt. These professionals may be able to outline strategies that help lower monthly obligations and provide more flexibility.

Get relief